1. Volume Indicator (حجم اشارہ):

1.1 Ta'aruf (Introduction):

Volume indicator, Forex trading mein ek ahem tool hai jo market mein hui trading activity ko measure karta hai. Yeh traders ko batata hai ke ek specific financial instrument ya currency pair ke liye kitna volume generate ho raha hai.

1.2 Kyun Zaroori Hai (Why It's Necessary):

2.1 Ta'aruf (Introduction):

Moving average, ek statistical calculation hai jo security ya currency pair ke past prices ka average nikalta hai aur isse trend ko smooth karta hai. Yeh trend analysis mein istemal hota hai.

2.2 Kyun Zaroori Hai (Why It's Necessary):

Volume indicator aur moving average, dono hi important tools hain jo traders ko market trends ko analyze karne mein madad karte hain. Volume indicator market activity ko measure karta hai jabke moving average trend smoothing aur support/resistance levels ko identify karne mein madad karta hai.

1.1 Ta'aruf (Introduction):

Volume indicator, Forex trading mein ek ahem tool hai jo market mein hui trading activity ko measure karta hai. Yeh traders ko batata hai ke ek specific financial instrument ya currency pair ke liye kitna volume generate ho raha hai.

1.2 Kyun Zaroori Hai (Why It's Necessary):

- Market Activity: Volume indicator market activity ko represent karta hai. Agar volume barh raha hai, toh yeh indicate karta hai ke market mein zor ka participation hai.

- Trend Confirmation: Price movements ko confirm karne ke liye, traders volume analysis ka istemal karte hain.

- Trend Reversals: Volume ki tafseelat se traders potential trend reversals ko bhi detect kar sakte hain.

- Bar Chart Ya Candlestick Chart Ke Sath: Volume indicator aksar bar chart ya candlestick chart ke sath use hota hai. Volume bars chart ke neeche dikhaye jate hain aur isse traders ko price movements ke sath volume ka comparison karne mein madad milti hai.

- Volume Bars: Simplest form of volume indicator where bars are drawn beneath the price chart.

- On-Balance Volume (OBV): Cumulative total of volume based on price movements.

- Volume Weighted Average Price (VWAP): Average price weighted by volume.

2.1 Ta'aruf (Introduction):

Moving average, ek statistical calculation hai jo security ya currency pair ke past prices ka average nikalta hai aur isse trend ko smooth karta hai. Yeh trend analysis mein istemal hota hai.

2.2 Kyun Zaroori Hai (Why It's Necessary):

- Trend Identification: Moving average ki madad se traders ko market mein chal rahe trend ka pata chalta hai.

- Support/Resistance Levels: Moving averages, support aur resistance levels ko bhi identify karne mein madad karte hain.

- Price Smoothing: Price volatility ko kam karke price movements ko smooth karna.

- Crossover Strategy: Moving averages ka crossover, jaise ke Golden Cross aur Death Cross, trend reversals ko identify karne mein madad karta hai.

- Support/Resistance: Jab price moving average ke paas aati hai, toh yeh support ya resistance provide kar sakta hai.

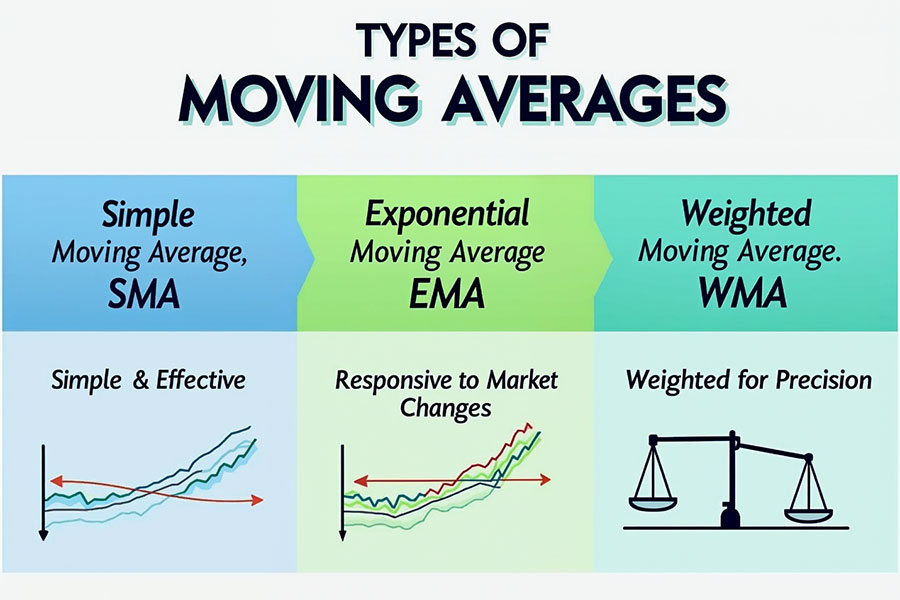

- Simple Moving Average (SMA): Prices ka simple average hota hai.

- Exponential Moving Average (EMA): Recent prices ko zyada weight deti hai, isse current market conditions ko better reflect karta hai.

Volume indicator aur moving average, dono hi important tools hain jo traders ko market trends ko analyze karne mein madad karte hain. Volume indicator market activity ko measure karta hai jabke moving average trend smoothing aur support/resistance levels ko identify karne mein madad karta hai.

تبصرہ

Расширенный режим Обычный режим